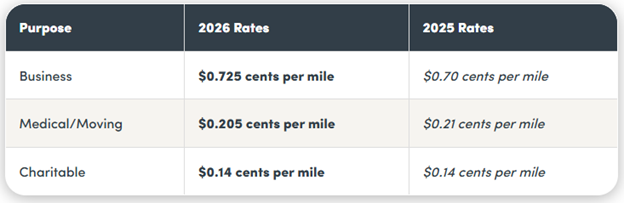

IRS INCREASES BUSINESS MILEAGE RATE FOR 2026 … MEDICAL MILEAGE RATES ARE DECREASED

Barry Weller

By Barry L Weller, EA

On 12/29/2025, the IRS announced that starting January 1, 2026 the standard mileage rates have increased 2.5 cents per mile for business travel while the mileage rate for vehicles used for medical purposes have decreased by half a cent. The 2026 mileage rate for charitable purposes remains that same at $0.14 per mile These rates apply to electric and hybrid-electric automobiles, as well as gasoline and diesel-powered vehicles.

Taxpayers can use the standard mileage rate but generally must opt to use it in the first year the car is available for business use. Then, in later years, they can choose either the standard mileage rate or actual expenses. Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen.

Barry L Weller, EA is the president of Barry Weller & Associates, Inc. with offices at 19 N Reading Ave, Boyertown, PA 19512 Phone (610) 367-8280. He is an enrolled agent, licensed to represent taxpayers before the IRS.